Long Term Capital Gains Tax Rate 2025 Canada

Long Term Capital Gains Tax Rate 2025 Canada - Capital Gains Tax Calculator 2025/25 Vita Aloysia, Under the new regime, it’s rs. This inclusion rate change comes into effect on june 25, 2025. Capital Gains Tax Rate 2025 Overview and Calculation, Select province and enter your capital gains. Calculate the annual tax due on your capital gains in 2025/25 for federal & provincial capital gains tax.

Capital Gains Tax Calculator 2025/25 Vita Aloysia, Under the new regime, it’s rs. This inclusion rate change comes into effect on june 25, 2025.

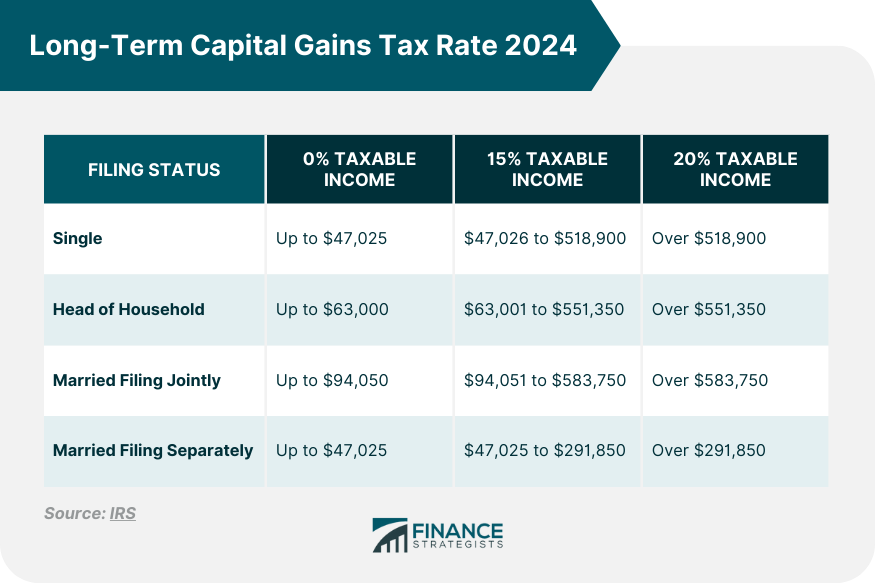

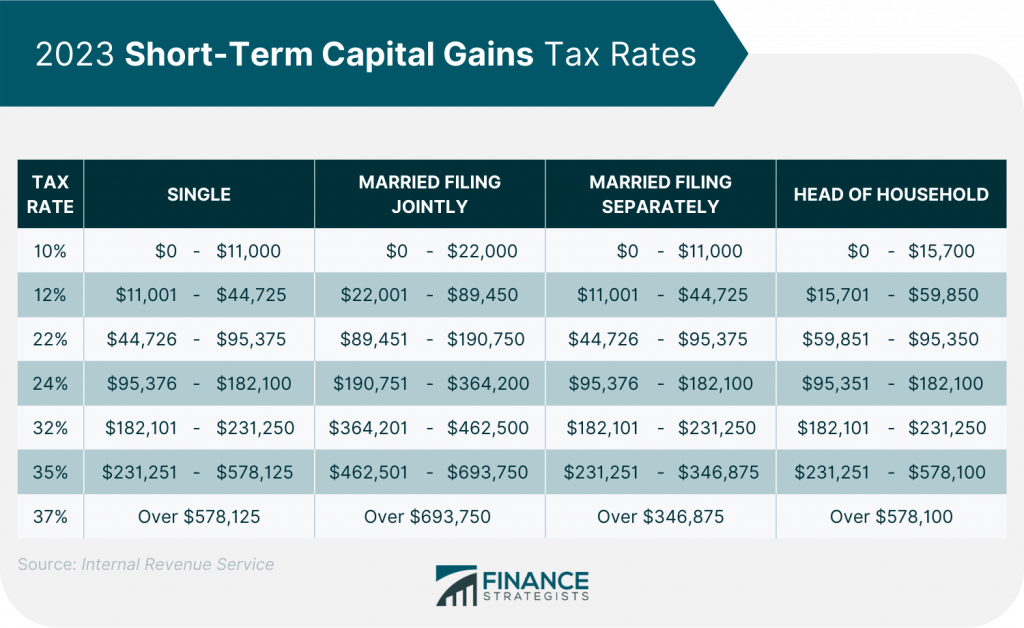

What Is The Long Term Capital Gains Tax 2025 Amii Lynsey, This could be real estate, stocks, bonds, or. The rates are 0%, 15% or 20%, depending on your taxable income.

The capital gains tax rate in canada can be calculated by adding the income tax rate in each province with the federal income tax.

Long Term Capital Gains 2025 Valli Ginnifer, The rates are 0%, 15% or 20%, depending on your taxable income. Calculate the annual tax due on your capital gains in 2025/25 for federal & provincial capital gains tax.

Capital Gain Tax Rates 2025 Myrta Tuesday, The adjusted cost base (acb) the outlays and expenses. The federal government has proposed an increase in the “inclusion rate” from 50% to 66.67% on capital gains above $250,000 for individuals.

Long Term Capital Gain Calculator 2025 Nomi Tallou, For instance, a taxable income of rs 10 lakh under the old regime has a tax liability of rs 1.17 lakh—an effective rate of 11.7%. The capital gains tax in canada refers to the tax applied to the profit (or gain) realized from the sale of a capital asset.

Deputy prime minister and minister of finance chrystia freeland speaks about changes to the capital gains tax inclusion rate, during a news conference on parliament hill in.

The capital gains tax in canada refers to the tax applied to the profit (or gain) realized from the sale of a capital asset.

Capital Gains Tax Increase 2025 Hanny Kirstin, You generally have a capital gain or loss whenever you sell, or are considered to have sold, capital. So if you sell your investment at a higher price than you paid, you will need to.

Irs Capital Gains Tax Rates 2025 Hannah Merridie, Calculate the annual tax due on your capital gains in 2025/25 for federal & provincial capital gains tax. What is a capital gains tax in canada?

Select province and enter your capital gains. The federal government has proposed an increase in the “inclusion rate” from 50% to 66.67% on capital gains above $250,000 for individuals.